The MISA license is a document that will more easily open you to the world of business in Saudi Arabia. Additionally, it will allow you to align with local legal practices which are critical to success. Additionally, if you seek appropriate advice, we assure you that you will be able to carry out the entire process without obstacles.

In this article, you will understand what is MISA license and the legal implications involved in obtaining this document. In addition, you will know how you can obtain it by carefully following all the steps and details given here.

What is a MISA License in Saudi Arabia?

The MISA Saudi License or Ministry of Investment License is a permit for foreign investors administered by the Saudi Government. Also, the registration aims to facilitate the process of founding a business or company in Saudi Arabia. In addition, it contributes to business in the case of taking advantage of foreign investment for 30 days.

Likewise, the license application will imply certain criteria that you must meet to guarantee that your company is by the law. Similarly, by obtaining the license, you will be able to begin the atonement of the company, thus contributing to the economy of the country. Generally, the processing of this license from application to issuance is approximately 2 to 4 weeks.

Also, comply with the renewal of the license so that the company does not have legal problems that stop its business processes. Equally, you need the renewal so that you do not lose time and money due to legal fines.

Importance of MISA License for Business in Saudi

Obtaining a MISA will allow you to have full ownership of your company located in Saudi Arabia. In addition, it gives you the advantage that you may not require any sponsor or receive restrictions related to capital. In conclusion, you will have full control of all business processes and all profits generated by your business.

Therefore, you can turn a Saudi Arabian company into an attractive option as a foreign investor.

Importance of MISA for Saudi Vision 2030

Saudi MISA facilitates Saudi economic transformation because it is aligned with the Saudi Vision 2030 which enables the creation of new businesses in the country. Furthermore, thanks to its application, it creates new viable options for foreign people who wish to invest in Saudi companies.

Likewise, MISA guarantees an easy and smooth process for interested investors. Hence, what you will need to establish your company in the territory of Saudi Arabia will be:

- Apply for and obtain a MISA.

- Select the commercial area with which you will do profit-making operations.

- Make the necessary registrations in the government entities legally established for this.

Difference between SAGIA License and MISA License

The Ministry of Investment Saudi Arabia or MISA is the current name of SAGIA or Saudi Arabian General Investment Authority. Thus, SAGIA was established in 2000 and was in charge of attracting investors and issuing licenses for local and international investors.

Nevertheless, in 2020 it was completely transformed and changed its name to MISA. This entity is in charge of issuing licenses for foreign investors and also supervises their investment within the country.

Benefits of Ministry of Investment Saudi Arabia (MISA) License in KSA

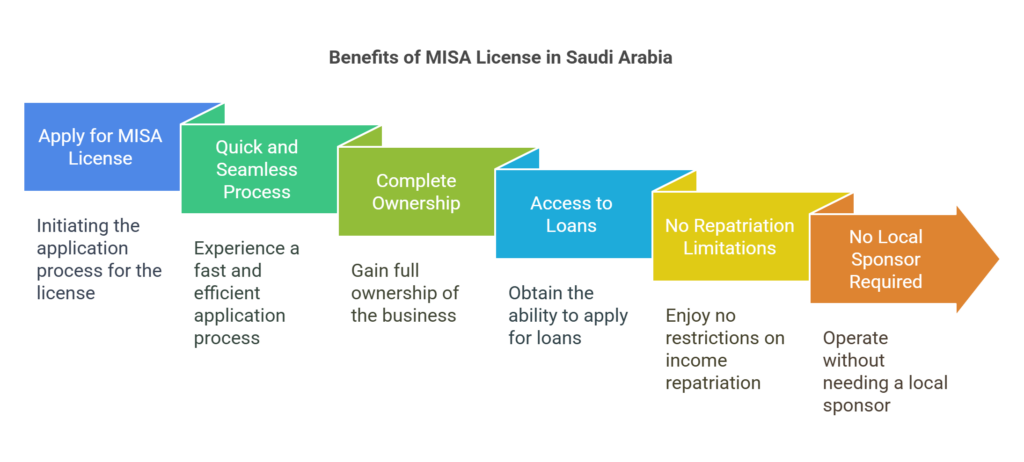

The MISA license KSA will offer you certain benefits that will make your entry into investment in Saudi Arabia more efficient. Next, you will see what benefits you will obtain with MISA:

Quick and Seamless Process

The first benefit it offers you is that the entire process of applying for it as well as the requirements will be easy to cover. Likewise, the process is fast and efficient which will give you the advantage of starting your business in just a few weeks.

Complete Ownership

When you obtain the license, you can be assured that you will receive full ownership of your company or business. In addition, you will be able to obtain full foreign ownership of the business, which prevents conflicts related to disagreements with the other partners involved in the company.

Access to Loans

By obtaining the Saudi MISA license, you will have the possibility to apply for the loans you need throughout the country. Likewise, you will receive the benefit of applying for these, with the support of Saudi investors, which will allow you to receive it more quickly

No Repatriation Limitations

With the license, you will not have any limitations on the amount of income you could repatriate from the business in KSA. You will multiply the profits obtained and you will be able to reinvest back into your company.

No Local Sponsor Required

The MISA license will allow you to do all business operations in Saudi Arabia without needing to be under the sponsorship of a Saudi citizen.

Sectors that will need a Saudi sponsor

Some sectors do need approval from other government departments to create the company. Consequently, it will limit the categories considered restricted for investors from outside the country.

Thus, if the business you want to find is within the list of restricted sectors, you will need to obtain additional approval from MISA. This approval will be requested before or after applying for the MISA license Saudi. Likewise, the permits for your company’s operations may vary.

An example is the foreign investment framework, where an investor will have 100% ownership of their company. However, there will be industrial sectors that will need a portion of Saudi ownership. The sectors included are:

- Real Estate Financing

- Communication

- Insurance or Reinsurance

- Construction or Engineering

Therefore, for this and other legal processes, it is advisable to request local advice to avoid inconveniences when creating a company.

Benefits of the Constitution of MISA Companies and Taxes

Regarding taxes, the Saudi government dictates that a business owner will get the following benefits by registering. These additional benefits after registration are:

- There will be no tax allocation for the owner of the business that starts in the country.

- The owner of a business will be able to have these benefits derived from all agreements when auditing between countries.

- Plus, you will not need to pay additionally for land, energy, water, and other resources.

- The tax will be reduced by approximately 50% for the cost produced at the expense of hiring and training citizens annually.

- Finally, reduction in tax slabs for those related to the company.

Required Documents for Applying for a MISA License

To obtain the MISA license, you will need little documentation as you will see below:

- Photocopy of the commercial record of the partner shareholder certified by the Embassy of Saudi Arabia. Besides, if the data is not registered in the ABSHAR system, you will need a Photocopy of the national identity document of the member. This is if the member of the company is a citizen of the GCC.

- Financial statements certified by the Saudi Embassy of the company of the previous movement.

On the other hand, as a foreigner, you will notice that investing could become a complicated process but by systematizing it you can make it easier.

Structured guide on how to get MISA license

To obtain the license from the Ministry of Investment of Saudi Arabia, you will be able to follow the following steps:

1. Adopt the appropriate business structure

The first step to starting a business is to select a legal entity that favors your business requirements. In addition, select a legal framework firmly linked to your business operations in areas of tax considerations and compliance in the local entity. Moreover, we suggest you seek advice from an expert to avoid problems in the process.

2. Prepare essential documentation

Have on hand all the documentation you will need for the Saudi MISA license application process. Likewise, you should ensure that all your documents are in the correct place to speed up the procedures and avoid inconveniences. Additionally, we recommend that you go to a consultant who will guide you in detail during this period and who is familiar with all local requirements.

3. Make the reservation of your company name

Your business name will be your own business identity, so select carefully based on your type of business. Also, if you decide to establish a branch, it will have to have the same name as the parent company. On the other hand, subsidiary companies are more flexible and allow you to place an additional word.

When choosing a name, also keep in mind that you must comply with local regulations regarding laws.

4. Draft the Articles of Association (AoA)

Another requirement for the MISA license for business is the drafting of the AoA which is not just a procedural requirement. Thus, you will have an operating system and stakeholder positioning. Additionally, we recommend having expert professionals in this phase that will ensure that your AoA is in line with local legalities. Likewise, it will contribute to a broad-spectrum business vision.

5. The CRE Commercial Registry

After the issuance of the MISA and its AoA, what follows is to obtain the Commercial Registry or CR for its acronym. Likewise, obtaining this certificate will be the formal indication that you will now be able to begin operations in your company. Thus, this government entity is the legal registrar of all those that have commercial operations in Saudi Arabia.

However, the MOC will request the statutes based on the Saudi Companies Law. Additionally, when you have complied with the legalities for MoC approval, a digital business registration will be issued for your company. Therefore, the deadline to receive the registration is 2 to 4 weeks depending on external license approval.

Also, do not forget to renew your registration and business license on time.

In conclusion, you need the MISA license to open your business in Saudi Arabia more easily. Furthermore, as is wise, Saudi Arabia offers a sea of opportunities for people who want to open a business in the country. However, you must obtain all the permissions and legalities in general for this.

However, if you still have questions about this topic or need additional advice, you can contact us and we will respond to your requests immediately.

Frequently Asked Questions

What is a MISA license Saudi Arabia?

The KSA license is a legal business license to establish a business in Saudi Arabia. Likewise, formerly an area known as the SAGIA license, allowed international companies to expand their operations in Saudi Arabia. Similarly, they will allow companies to be started without the need for sponsors or capital restrictions.

How do I apply for MISA?

On how to apply MISA license, you must send the relevant documents to the government entities in charge of this task.

What is the cost of a MISA license in Saudi Arabia?

This license will cost for registration fees plus renewal of SAR 60,000 and SAR 1,200 for commercial registration and its renewal.

What documents are needed when applying for the MISA license?

What you will need to begin the process to acquire the license will be to submit the following documents:

- Social regulations

- A commercial registration or its equivalent

- Financial statement of the previous year

Additionally, all these documents must be approved by the local Saudi Arabian Consulate.

What are the types of work permit in Saudi Arabia?

The types of commercial companies or work permitted are:

- LLC or Limited Liability Company where the owners will not be responsible for the business debt

- SPLLC or the Sole Proprietorship Limited Liability Company. It is a variant of the LLC, where the owner has all of the business shares.

- JSC or Joint Stock Company. In this type of company the capital will be divided and distributed into shares with equal value

- LLP or Limited Liability Partnership is formed by the union between the general partners and the limited partners.

- The Joint Venture agreement, where two or more parties can agree to contribute resources and thus meet the objective of the organization.

- Branch or representative office. The offices are a business form for foreign companies to operate in Saudi Arabia.